Meaning

NFT Finance, also referred to as NFTfi, represents the fusion of nonfungible tokens (NFTs) and decentralized finance (DeFi), resulting in a powerful amalgamation that opens up boundless opportunities for inventive financial solutions.

By enabling the financialization of NFTs, NFTfi applications enhance the liquidity and capital efficiency of NFT assets, offering the potential to generate tangible returns from underutilized assets.

A plethora of possibilities awaits exploration, ranging from utilizing NFTs as collateral to obtain loans for deferred payments, to embracing the concept of collective ownership.

NFT Lending & Borrowing

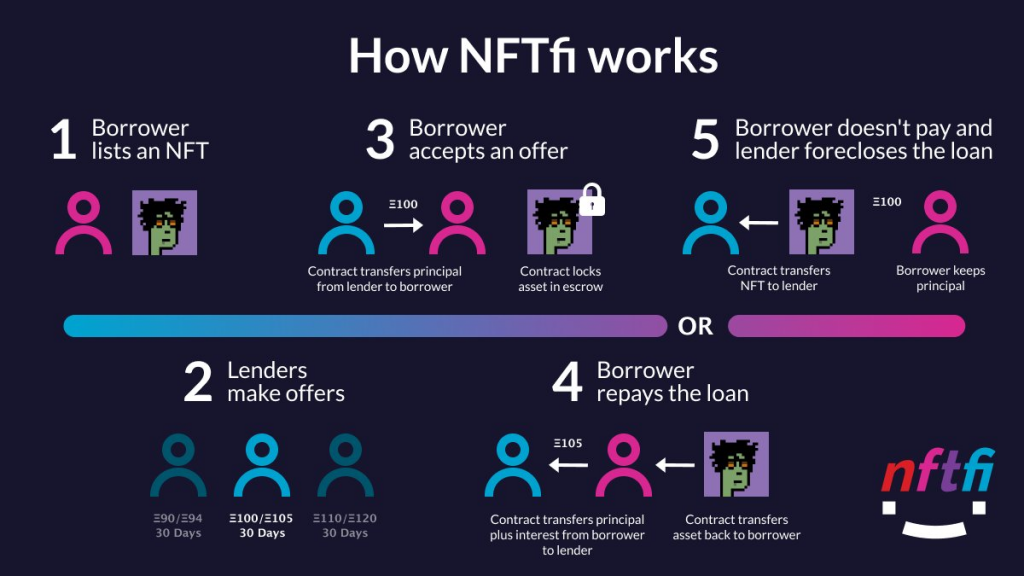

Within the realm of NFTfi, decentralized lending protocols form a crucial segment. These protocols employ permissionless smart contracts, enabling users to borrow and lend against their valuable NFT assets. This innovative approach empowers NFT holders to unlock the intrinsic value of their assets without the necessity of selling them.

While certain NFT lending decentralized applications (dApps), such as NFTfi and X2Y2, operate in a peer-to-peer manner, others, like BendDao, adopt an alternative approach known as the peer-to-pool model.

On peer-to-peer platforms, the process unfolds as follows: The borrower puts up their NFT as collateral to secure a crypto loan. Subsequently, the lender presents a loan offer, leveraging the NFT as collateral to earn interest. Should the borrower accept the offer, they are obligated to repay the borrowed amount along with the accrued interest by the end of the loan term. However, failure to fulfill the repayment results in the lender assuming ownership of the NFT.

The majority of decentralized lending and borrowing platforms offer flexibility in terms of loan customization. For instance, NFTfi allows borrowers to secure loans in wETH, DAI, and USDC, while utilizing their NFTs as collateral. Borrowers have the ability to set their preferred loan amount denominated in these currencies, along with specifying the desired interest rate and loan duration. These parameters provide lenders with insights into the borrower’s expectations, enabling them to make suitable loan offers based on the provided information.

Conversely, BendDao, the peer-to-pool liquidity protocol, offers NFT holders the opportunity to obtain immediate ETH loans backed by their NFTs. In this scenario, lenders do not make direct loan offers. Rather, they contribute liquidity to the protocol by depositing ETH.

Fractionalizing NFTs

The process of NFT fractionalization creates avenues for collective ownership by dividing high-value NFT assets (ERC-721) into multiple tokens (ERC-20). This opens up a wide range of applications, including community collections, crowdfunding donations, and the formation of new decentralized autonomous organizations (DAOs).

For instance, platforms like Unic.ly and NFTx.io allow you to fractionalize NFTs, place them into secure vaults, and generate share tokens through the protocols. These share tokens can then be staked on decentralized exchanges, enabling you to earn rewards from the staking process.

PartyBid offers you the opportunity to form a collective and invest in NFT assets together. By joining forces, you can support charitable causes, collectively own NFTs, and reap the benefits of shared NFT utilities.

BNPL for NFTs

Thanks to the Cyan dapp, the Buy Now, Pay Later (BNPL) concept has made its debut in the NFT space, enabling individuals to gradually acquire ownership of an asset by repaying the debt in installments.

When users initiate a Buy Now, Pay Later (BNPL) plan on Cyan, they make an initial down payment followed by four subsequent installments. The remaining installments need to be paid every 31 days to complete the payment cycle.

Once the plan is initiated, the user receives a cNFT (collateralized NFT) version of the original NFT, granting partial ownership. The cNFT allows the user to enjoy certain benefits associated with the underlying NFT, including receiving airdrops of both ERC-20 and ERC-721 tokens.

By initiating the BNPL plan and maintaining the cNFT in your wallet while fulfilling all payment obligations, you can reap the rewards. Upon completing the final payment, you will receive the original NFT in your wallet, granting you full ownership.

Halliday presents an alternative BNPL solution that employs a distinct approach. By integrating with NFT games or marketplaces, Halliday enables the inclusion of a BNPL payment option during the checkout process. As a result, users have the opportunity to swiftly utilize game assets while spreading out the payment for full ownership across four installments.

The convergence of DeFi and NFTs presents a wide array of possibilities. Whether you seek to invest in NFTs or unleash the potential of your current assets, NFTfi has something valuable to offer for all individuals.